Italy’s machine tool, robotics, and automation sector is cautiously entering 2025 with expectations of mild growth after enduring a significant downturn in the previous year. The domestic market experienced a steep contraction in 2024, yet the industry managed to hold its place on the global stage—retaining its position as the fifth-largest producer and fourth-largest exporter worldwide, based on figures from industry body Ucimu-Sistemi Per Produrre.

In 2024, total production within the sector declined sharply by 16.9%, reaching €6.3 billion. Domestic demand plunged, resulting in a nearly 40% drop in local deliveries. At the same time, machinery imports shrank by 31.8%, settling at €1.65 billion. This combination of weakening internal demand and reduced import activity reflected broader market uncertainty and cautious investment behavior.

Amid these challenges, foreign sales became a rare source of momentum. Exports increased modestly by 1.2%, hitting a new high of €4.27 billion. Positive performances were noted in markets such as the United States (up 10.9%), Germany (1.6% growth), and India (a notable 58.3% rise). However, demand decreased in other key destinations, including China and France, which saw double-digit contractions. Conversely, Spain and Sweden registered strong increases, with Swedish demand surging over 70%.

Looking to 2025, Ucimu’s research division projects a mild rebound across several metrics:

- Production is forecasted to grow by 2.6%, reaching approximately €6.49 billion

- Exports are set to rise by 1%, potentially establishing a new record at €4.31 billion

- Domestic shipments may increase by 5.9%

- Imports are expected to recover slightly, with a 4.9% gain

Despite the slightly improved outlook, significant risks remain. The broader geopolitical climate—marked by trade disputes, conflicts, and the threat of protectionism—continues to cloud projections. Ucimu underscores the importance of adopting a cautious and adaptive approach amid such volatility.

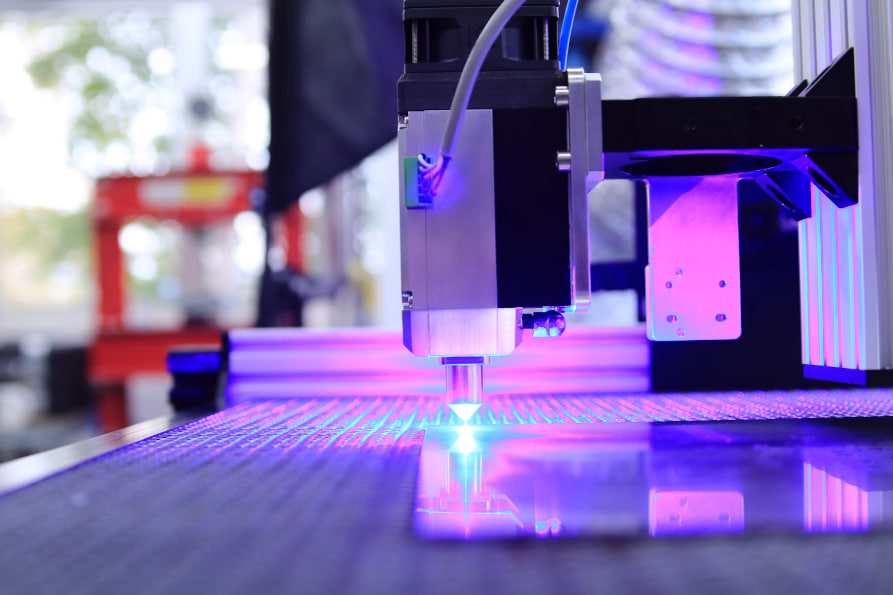

To support sustainable recovery, industry leaders are urging ongoing investment in technological advancement, digital transformation, and workforce training. Initiatives such as Transition 4.0 and 5.0 are seen as critical levers for driving competitiveness. Italy’s industrial base must remain closely aligned with evolving European manufacturing ecosystems, especially as countries like Germany pursue major reindustrialisation agendas.

One prominent strategic effort is the UCIMU Academy, which focuses on bridging the skills gap through stronger collaboration between businesses, technical schools, and universities. The program aims to equip future professionals with the knowledge and experience needed to navigate increasingly automated and digitized production environments.

Additionally, sector leaders are monitoring global shifts such as the electrification of the automotive industry and evolving trade regulations, particularly those that could influence access to U.S. markets. While direct impacts from tariffs may currently be limited, indirect consequences through multinational supply chains remain a concern.

As Italy’s manufacturing sector recalibrates after a turbulent year, stakeholders are calling for unified efforts to reinforce resilience and secure long-term growth.